Make Life Easier

Tax Services Midstream

Tax Services - Midstream

With our tax knowledge and experience we will find the optimal, effective tax structure that will suit your business and operations. The aim of our tax planning services is to analyse and review the tax wealth of our clients and provide the best possible tax structures to keep our clients and SARS happy.

We also have our own internal tax management system to ensure that no tax deadline is missed ensuring our clients remain tax compliant and avoid penalties and interest.

Specific Tax Services We Offer

Individual & Corporate Income Tax

- Registrations

- Deregistrations

- Turnover Tax Registrations

- Tax Representative Registrations

- E File registration

- Company Tax Returns (ITR14)

- IT14SD

- Individual tax Returns (ITR12)

- Provisional Tax Returns (IRP 6)

- Dividends distribution and declaration

- Tax Planning and Structuring

- Tax Consulting

Value Added Tax (VAT)

- Registrations

- Deregistrations

- VAT Calculations, Review and Reconciliations

- VAT Returns (VAT201)

South African Revenue Service Administration

- SARS Communication

- Tax Registrations

- SARS Audits and Verifications

- Tax Corrections, Verifications / Audits and Disputes

- Tax Compliance and Debt Management

Payroll (PAYE, UIF and SDL) Tax Management

- Registration

- Deregistration

- PAYE Returns & Submissions (EMP 201)

- EMP 501 and IRP5 Certificates

- Unemployment Insurance Fund (UIF) Returns

- Skills Development Levy

- Workman Compensation Registration Annual Returns

Individual & Corporate Income Tax

Individual/Company Tax Returns

Corporate tax includes taxes paid by companies or close corporations, on their annual taxable income

Individuals who earn taxable income (subject to various exemptions and rebates) are also liable to pay income tax

South Africa has a residence-based tax system, which means residents are, subject to certain exclusions, taxed on their worldwide income.

By contrast, non-residents are taxed on their income from a South African source

Provisional Tax Returns (IRP 6)

Provisional tax is not a separate tax from income tax. It is a method of paying the income tax liability in advance, to ensure that the taxpayer does not have a large tax debt on assessment

It requires the taxpayers to pay at least two tax amounts in advance.

Provisional taxes are usually paid in February and August.

Dividends Distribution & Tax Management

Dividends received by individuals from South African companies are generally exempt from income tax, but dividends tax at a rate of 20% is withheld by the entities paying the dividends to the individuals.

Declaring dividends will have some tax consequences and filing duties.

Let us handle it so you know it is done right by professionals.

Tax Planning, Structuring and Consulting

Tax planning is not just about filling out tax forms and paying taxes.

Tax planning is an entire process where you use carefully designed and planned strategies to reduce your tax liability legaly.

Most businesses do not take advantage of these opportunities but it can give you a competitive advantage.

Due to the complexity and various forms of taxes governed through the South African Tax Laws many clients are overwhelmed and unsure about tax implications applicable in their personal capacities and businesses.

Through our tax expertise and experience we provide tax consulting to address any tax problems and questions our clients might have

Value Added Tax (VAT)

VAT Registrations

It is compulsory for a business to register for VAT if the total value of taxable supplies made in any consecutive twelve month period exceeded or is likely to exceed R1 million

Non-resident suppliers of certain electronic services are also liable for compulsory VAT registration at the end of the month in which the total value of taxable supplies exceeds R1 million.

A business may also choose to register voluntarily for VAT if the value of taxable supplies made or to be made is less than R1 million, but has exceeded R50 000 in the past period of 12 months.

VAT Calculations, Review and Reconciliations

Many businesses run into cash flow problems because they didn’t manage their VAT liability properly—paying themselves too much or not at all from what was due to them according their accounting records.

We ensure the correct VAT liability is calculated from the accounting records provided to us. We also review client's VAT calculations. We perform VAT reconciliation to ensure accuracy and completeness of VAT liability and turnover declared, between SARS and the client.

VAT Returns

A vendor is required to submit VAT returns and make payments of the VAT liabilities (or claim a VAT refund) on or before the 25th day or the last business day of the month following the month in which the vendor’s tax period ends.

VAT periods can range from monthly, 2 month period or 6 month period or annually.

South African Revenue Service Administration

SARS Communication

SARS has various forms of communication.

Communication takes place through call centres, e file profiles, online booking system and visit of popup tax branches.

With a signed tax power of attorney clients can appoint us as the tax practitioners to act and communicate on behalf of our clients with regards to tax affairs.

We also update and maintain registered details of taxpayers with SARS.

SARS Registration

We perform tax registrations for individuals.

Corporate entities are automatically registered for income tax when registered at the Company Intellectual Property Commission (CIPC).

We perform registration of e-filing profiles and tax representatives.

We can also perform registrations for Turnover Tax and perform application for tax exemption.

Tax Corrections, Verifications/Audits and Disputes

If a mistake was made, the Request for Correction process allows you the ability to correct a previously submitted return/declaration.

Non-compliance penalties and/or interest can be remitted in whole or in part through request for Remission process.

Where a taxpayer doe snot agree with an assessment the taxpayer may, request SARS to provide the reasons or lodge a dispute.

We provide all of the above services for taxpayers.

Tax compliance and Debt Management

In instances where taxpayers are not compliant and have outstanding tax debt owing to SARS we can assist these taxpayers with payment arrangements and compromises

Taxpayers, both individuals and businesses, are required to be fully tax compliant through on time submission of returns and payments.

We assist taxpayers that are not tax compliant to become tax compliant again through our tax assessment and corrections processes.

Payroll Taxes Management

PAYE Registration

An employer must register with the South African Revenue Service (SARS) within 21 business days after becoming an employer, unless none of the employees are liable for normal tax.

An employer, who needs to register with SARS, for PAYE and/or SDL, also needs to register to pay UIF contributions

Where an employer is liable to pay SDL, the employer must register with SARS and show the jurisdiction of the Skills Education and Training Authority in South Africa (SETA) within which they must be classified..

PAYE Returns & Submissions (EMP 201's)

The amounts deducted or withheld by the employer must be paid to the South African Revenue Service (SARS) on a monthly basis, by completing the Monthly Employer Declaration (EMP201).

An employer must issue an employee with an IRP5/IT3(a) where remuneration is paid or has become payable.

EMP 501 and IRP5 Certificates

An employer must issue an employee with an IRP5/IT3(a) where remuneration is paid or has become payable.

An employer needs to submit a reconciliation between the declared and paid amount to SARS with regards to Employees’ Tax [Pay-As-You-Earn (PAYE)], Skills Development Levy (SDL), Unemployment Insurance Fund (UIF) and/or Employment Tax Incentive (ETI).

This is done bi-annually.

Unemployment Insurance Fund (UIF) Returns and Skills Development Levy (SDL)

The Unemployment Insurance Fund (UIF) gives short-term relief to workers when they become unemployed or are unable to work.

SDL is a levy imposed to encourage learning and development in South Africa and is determined by an employer’s salary bill.

It must be declared and paid to SARS within seven days after the end of the month during which the amount was deducted.

Workman Compensation Registration and Annual Returns

Anyone who employs one or more part- or full time workers must register with the Compensation Fund and pay annual assessment fees based on annual returns submitted by the employer.

The Compensation Fund is a trust fund that is controlled by the Compensation Commissioner and employer contributes to the Compensation Fund. Therefore employers should register at the Workman Compensation Fund.

The Workmen's Compensation policy provides payment for legal compensation to Employees or their dependants in case of injury and accident of the employees at workplace (including certain occupational disease) arising out of and in the course of employment and resulting in disablement or death.

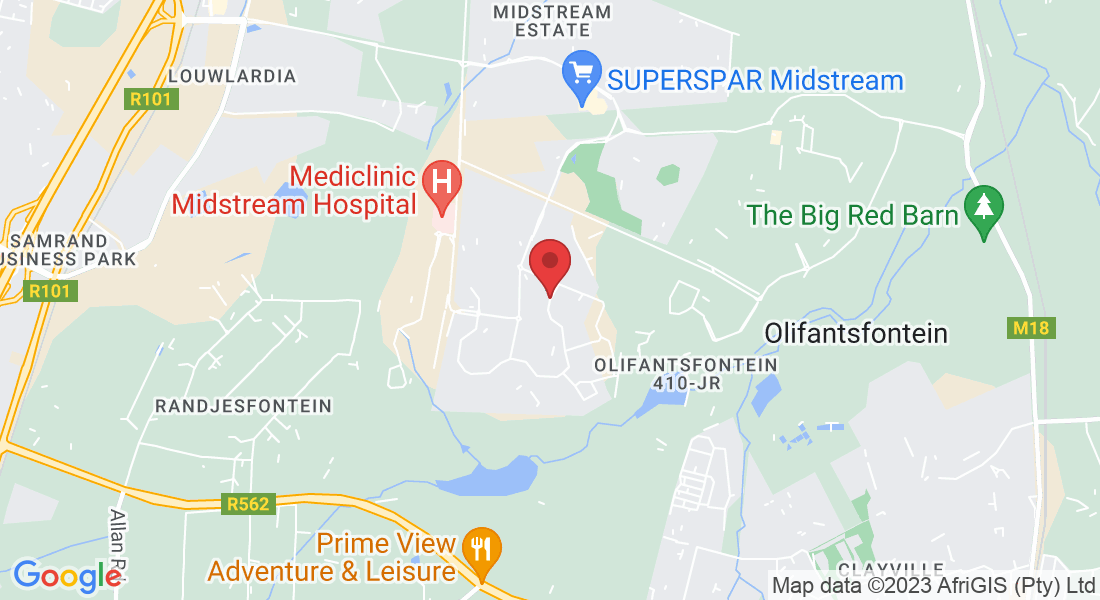

Business Address

Address:

Co-Work @ Midstream.

Midlands Office Park West

Mount Quray Road

Midstream Estate

Centurion