Make Life Easier

Business Solution Packages

Both packages include:

Monthly Accounting, Taxation and Payroll Services (limited to these functions provided in the packages)

Cloud based software and systems that we supply to be used in our clients' businesses that help our clients to be in control of their cash flow, manage profits and enabling them to have more free time and money in their pocket, all while remaining compliant.

Guidance to clients through our expertise and experience to implement the correct/effective systems and processes.

Providing of timeous, relevant and accurate financial information to our clients

Business Solution

(Support and Compliance)

Initial business and tax compliance assessment by the Tax Shop

- Performing of an assessment in terms of taxation, statutory and payroll compliance

- Provide feedback to the taxation and statutory compliance status of business

- Provide feedback/assistance to the necessary registrations/submission to ensure compliance

Client conducting, and managing business on cloud-based software

- Client can conduct and apply all the business functions from any location, on the software provided

- The following cloud-based software will be provided:

- Xero – Business platform and tool for business operations including business accounting software (Financial record keeping)

- DEXT – Document scan and storage function (Suppliers processing)

- Pay Space – Payroll function (Salaries)

- Client can perform invoicing and debtor management functions on Xero software

- Client has access to the financial functions, provided by the Tax Shop, in the business accounting software

- Client and personnel have access to Employee Self Service (employees can access their own payslips/apply for leave/amend personal details etc)

Client access to cloud-based business accounting software

- Client will have access to all the cloud-based business software via laptop/desktop or mobile.

Monthly processing and maintenance of business records by the Tax Shop (Finance function)

- Processing of bank payments and bank receipts

- Matching of cash slips/bills/creditor invoices (from DEXT) with bank and cash payments

- Matching of cash receipts and sales invoices with bank and cash receipt

- Monthly bank and cash reconciliation

- Monthly debtor, creditor and cash maintenance

- Fixed asset register recording and maintenance

- General ledger maintenance – process of manual journals to account for financial information not processed via bank accounts and ledger control account reconciliations

- Processing and maintenance of payroll function (includes optimal tax management of taxable earnings)

- Drafting of financial reports such as management accounts

Software support and training by the Tax Shop

- Ongoing support and training from the Tax Shop to operate business accounting and operational software and other related applications provided for by the Tax Shop

- Dedicated accountant available via e-mail/telephone for any support related queries

Business set up on all software used

Ongoing support and training from the Tax Shop:

- Set-up of the whole business and historical financial information on to Xero, DEXT and Pay Space

- Set up of all users on computers and mobile devices

Continuous business and tax compliance by the Tax Shop

- Monthly compilation of management accounts

- Annual compiled financial statements

- Annual CIPC Returns

- Equity Reporting (if applicable)

- Bi-Monthly VAT 201 Returns (Value Added Tax returns to SARS) and VAT reconciliation

- Monthly payroll processing and issuing of payslips

- Monthly EMP 201 PAYE, UIF and SDL returns

- Bi-Annual EMP 501 declarations

- Annual workman compensation declarations

- Annul Tax Returns (Individual/Statutory entity) - IT14 (Includes tax calculation and submission to SARS)

- Bi-Annual Provisional tax return – IRP6 – twice a year (Includes submission to SARS) -Includes provisional tax calculation and submission

File Management and Storage system

- Software that provides storage functionality to store business information (invoices, contracts, information) in the cloud with easy access

- Scan and store expense invoices/slips (DEXT)

- Electronic allocation and processing of scanned supplier invoices and slips

Business tax structuring and advice (advice and planning services not requiring extensive time and complexity)

- Tax advice and planning that forms part of annual tax calculation (advice and planning services not requiring extensive time and complexity)

Elite Business Solution

(Financial Management Function)

Initial business and tax compliance assessment by the Tax Shop

- Performing of an assessment in terms of taxation, statutory and payroll compliance

- Provide feedback to the taxation and statutory compliance status of business

- Provide feedback/assistance to the necessary registrations/submission to ensure compliance

Client conducting, and managing business on cloud-based software

- Client can conduct and apply all the business functions from any location, on the software provided

- The following cloud-based software will be provided:

- Xero – Business platform and tool for business operations including business accounting software (Financial record keeping)

- DEXT – Document scan and storage function (Suppliers processing)

- Pay Space – Payroll function (Salaries)

- Syft Financial Reporting – Financial reporting and analyses function

- POS - A preferred/advised Point of Sale function

- Stock Management - A preferred/advised stock management function

- Any other advised software application integrated with Xero

- Client can perform invoicing and debtor management functions on Xero software

- Client has access to the financial functions, provided by the Tax shop, in the business accounting software

- Client and personnel have access to Employee Self Service (employees can access their own payslips/apply for leave/amend personal details etc)

Client access to cloud-based business accounting software

- Client will have access to all the cloud-based business software via laptop/desktop or mobile.

Weekly processing and maintenance of business records by the Tax Shop (Finance function)

- Processing of bank payments and bank receipts

- Matching of cash slips/bills/creditor invoices (from DEXT) with bank and cash payments

- Matching of cash receipts and sales invoices with bank and cash receipts

- Weekly bank and cash reconciliation

- Weekly debtor, creditor and cash maintenance

- Weekly review and follow up of outstanding debtors with debtors’ clerk

- Fixed asset register recording and maintenance

- Weekly review of stock reconciliation and assistance with stock maintenance

- General ledger maintenance – process of manual journals to account for financial information not processed via bank accounts and ledger control account reconciliations

- Processing and maintenance of payroll function (includes optimal tax management of taxable earnings)

- Drafting of financial reports such as management accounts with specific and customised key performance indicators

Software support and training by the Tax Shop

- Ongoing support and training from the Tax Shop to operate business accounting and operational software and other related applications provided for by The Tax Shop

- Providing assistance and support to staff with regards to the application of operational systems and procedures as designed and approved from the “Business restructuring” process (if applicable)

- Dedicated accountant available via e-mail/telephone for any support related queries

Business set up on all software used

Ongoing support and training from the Tax Shop:

- Set-up of the whole business and historical financial information on to Xero, DEXT, Syft Financial Reporting and Pay Space (excl other operational software recommended during "Business restructuring" process)

- Set up of all users on computers and mobile devices

Continuous business and tax compliance by the Tax Shop

- Monthly compilation of management accounts

- Annual compiled financial statements

- Annual CIPC Returns

- Equity Reporting (if applicable)

- Bi-Monthly/Monthly VAT 201 Returns (Value Added Tax returns to SARS) and VAT reconciliation

- Monthly payroll processing and issuing of payslips

- Monthly EMP 201 PAYE, UIF and SDL returns

- Bi-Annual EMP 501 declarations

- Annual workman compensation declarations

- Annual Tax Returns (Individual/Statutory entity) - IT14 (Includes tax calculation and submission to SARS)

- Bi-Annual Provisional tax return – IRP6 – twice a year (Includes submission to SARS) -Includes provisional tax calculation and submission

File Management and Storage system

- Software that provides storage functionality to store business information (invoices, contracts, information) in the cloud with easy access

- Scan and store expense invoices/slips (DEXT)

- Electronic allocation and processing of scanned supplier invoices and slips

Business tax structuring and advice (advice and planning services not requiring extensive time and complexity)

- Tax advice and planning that forms part of annual tax calculation (advice and planning services not requiring extensive time and complexity)

Monthly profitability and financial management feedback by the Tax Shop (Financial Management)

- Monthly feedback on the performance of business based on profit and loss/ balance sheet statements

- Recommendations for areas of improvements/risk/focus based on profit and loss/balance sheet statements

- Recommendations for areas of improvements/risk with regards to systems and processes

- Ongoing advice to improve business efficiency and structures based on profit and loss/balance sheet

- Financial reporting analyses based on ratios, KPI’s, cashflow forecasts and budget vs actual review (Done with Client as value-add service)

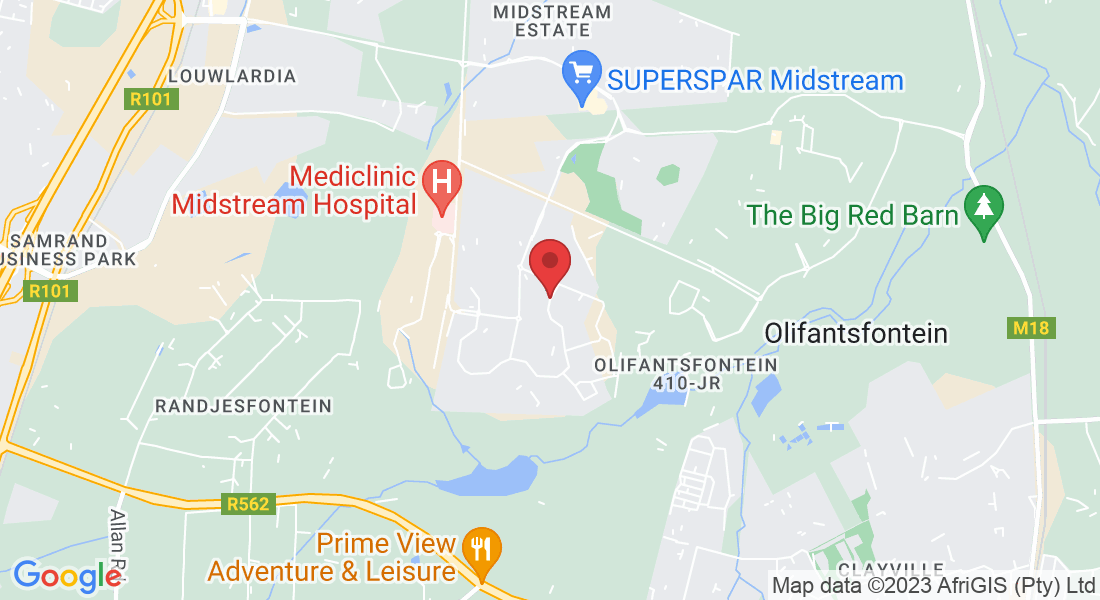

Business Address

Address:

Co-Work @ Midstream.

Midlands Office Park West

Mount Quray Road

Midstream Estate

Centurion