Make Life Easier

Advisory Services Midstream

Advisory Services

Through our advisory services we enable our clients to work smarter and grow faster. We consult with our clients to build effective organisations, innovate and grow, reduce costs, manage risk and regulation . Our aim is to support you in designing, managing and executing lasting beneficial change.

We help our clients to identify and implement cost-saving initiatives, improve management and control, identify and manage risk and improve quality, address financial under-performance and manage cash flows.

Our understanding of finance, risk management/compliance, IT systems, operations and human resources facilitates an integrated approach.

Our Areas of Focus

Business Restructuring

We provide peace of mind during the tough and challenging time your business can often be confronted with during a restructure or a dire financial crisis requiring recovery intervention.

As part of our restructuring services we conduct a review on the viability of a business identifying financial, strategic and operational issues that are critical to stakeholders such as management, lenders and investors.

Through reviewing and critiquing a business, operationally and financially, we establish an appropriate strategy and implement the necessary changes.

Our primary aim is to develop practical and appropriate operational & financial solutions and recommendations for the benefit of all stakeholders

Corporate Finance and Structuring

We understand the needs of your business and the context in which it operates. As a trusted business advisor we can assist you to make smart business decisions based on accurate analysis and experience.

Whether you are buying or selling, you often need creative solutions and recommendations. We will assist you in investigating potential opportunities, analyse the risks, threats and industries

We can assist with the following:

- Financial and tax due diligence

Providing of due diligence reviews will assist you with regulatory requirements, tax structuring and financial modelling.

- Valuations

We can deliver comprehensive and robust for individuals and companies across a wide range of sectors.

Risk Advisory

Businesses are being impacted by increased expense through financial, economic, environmental, technological, political and social factors. Managing this change is vital to ensure your business remains relevant and maintains its competitive advantage.

Risk management allows you to align your goals with operations to ensure you achieve your strategy.

Through a process of risk identification and assessment we can identify the relevant internal controls to mitigate your risk to an acceptable level.

As part of our risk advisory process we perform a comprehensive review of the overall effectiveness of a client's internal control function.

The internal control structure of a business is derived from the way management runs an operation or function and is integrated with the management processes.

Company Secretarial Services

We understand the importance of corporate governance and the demands made on companies and directors.

The Companies Act requires that statutory books and records be maintained within the parameters of the law.

Our service offering includes:

- Registration of private, public, external, private liability and non-profit companies

- Conversions of close corporations

- Maintenance of statutory records

- Submission of Annual Returns

- Amendments to and registration of statutory details

Management Advisory

We provide advice and guidance to help our clients grow their organisation, create value, improve business performance, and deliver result

Our service offerings includes:

- Review and recommendation of the effectiveness and efficiency of business systems and processes

- Recommendation and implementation of business software applications (POS, Document Storage, Invoicing and Stock Management systems, Accounting and Financial Reporting)

- Profit and Cash Flow review analyses and recommendation for improvements

- Budget and Cash flow forecasting and performance measurement

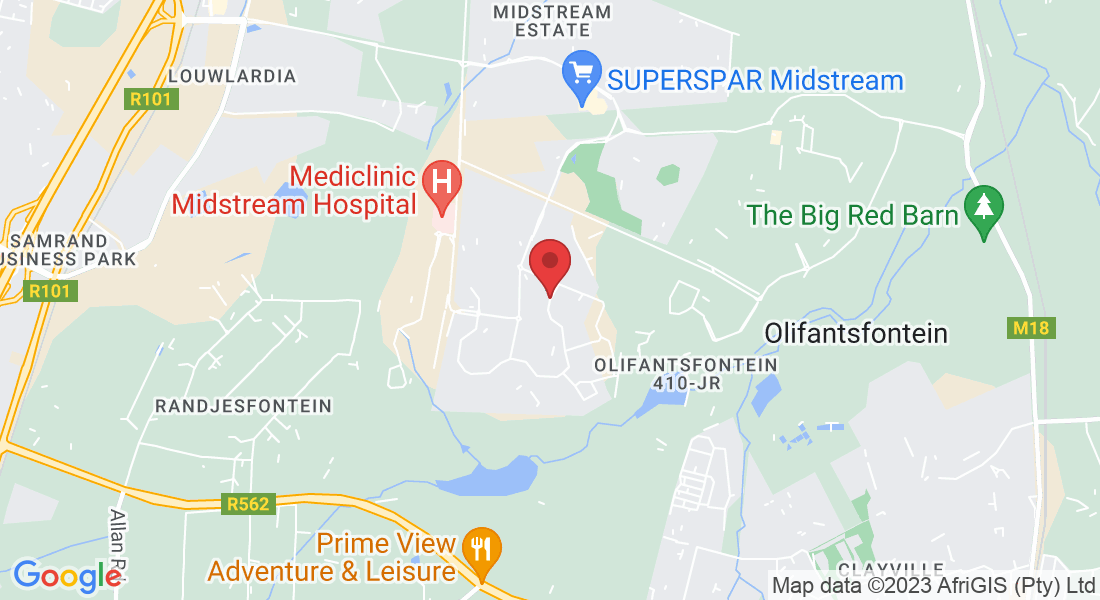

Business Address

Address:

Co-Work @ Midstream.

Midlands Office Park West

Mount Quray Road

Midstream Estate

Centurion